Guide to the National Living Wage – how much should I pay my staff?

The National Living Wage was introduced by the UK Government on 1st April 2016 with the goal of being an enhancement to the National Minimum Wage for workers aged 25 or over. In this guide to the National Living Wage (NLW) we look at the plan to put it on a path to reach two-thirds of median hourly pay (of those aged 21 and above) by 2024, which has taken another step forward as of 1 April this year.

GUIDE TO THE NATIONAL LIVING WAGE: HISTORY

The National Minimum Wage (NMW) was introduced by the Labour Government in 1999. The National Living Wage was introduced as an enhancement to the NMW for those aged 25 and the plan was that the hourly rate would reach £9 by 2020. This target was missed however, as the rate reached only £8.72 per hour by the end of 2020. As recommended by the Low Pay Commission, the standard National Living Wage (for those aged 22 or over) will increase to £10.42 (9.7%). Other ages bands receive the same percentage increase, apart from those aged 21 – 22 who see an increase of 10.7% as the Government seeks to equalise minimum pay for all those 21 or over by 2024.

WHAT SHOULD I PAY MY STAFF?

“With inflation and the cost-of-living crisis continuing to bite, now more than ever, it’s critical for businesses to pitch their pay and benefits package at the correct level,” says KPI’s Industrial Recruitment Director Andy Wragg. “Pitch it too low and recruitment will be problematic and staff retention will suffer. Pitch it too high and profitability could suffer. KPI’s unique approach to staffing can help take the burden of recruitment away and we can assist with structuring packages which will attract and retain staff. The important principle to remember is that the wage you pay your staff is NOT the be all and end all,” says Andy, “but if you are offering other incentives such as subsidised travel, meals, free uniform or staff discount, it’s crucial these benefits are emphasised during recruitment and induction.” Additional factors that can influence your employees include:

- working conditions

- incentives & rewards

- management style

- employee discounts

- induction and training

- development opportunities

- flexible working

“The key takeaway here is that pay is only part of the package and other factors can make a big difference to employees at every level,” says Andy. “Businesses should also take notice of the market and what competitors are offering and heed the penalties for not paying the National Living Wage.”

NATIONAL LIVING WAGE RATES TO APPLY FROM APRIL 1ST 2023

| Age Band | Rate from April 2023 | Annual increase (£) | Annual increase (%) |

| National Living Wage | £10.42 | £0.92 | 9.7% |

| 21–22-Year-Old Rate | £10.18 | £1.00 | 10.9% |

| 18–20-Year-Old Rate | £7.49 | £0.66 | 9.7% |

| 16–17-Year-Old Rate | £5.28 | £0.47 | 9.7% |

| Apprentice Rate | £5.28 | £0.47 | 9.7% |

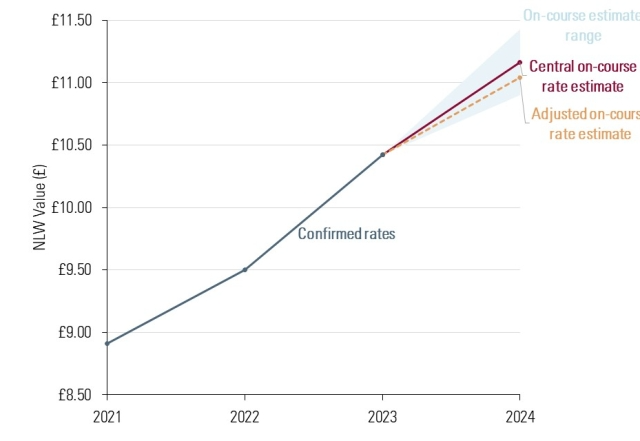

The LPC estimates the recommendation of £10.42 will be 63.9 per cent of median hourly pay in October 2023 which takes a big step towards the 2024 target.

In the last 12 months, nominal pay growth and projections for future pay advances have increased, raising the estimate of the 2024 target from £10.70 to £11.08. The LPC predicts that a lesser rise will be required next year (6.2 per cent, £0.66) to meet the 2024 target, than the 2023 proposal (9.7 per cent, £0.92). This is due to:

- Wage growth forecasts are stronger for this year than next: median pay is estimated to grow by 5.5 per cent between April 2022 and April 2023, but only 4.2 per cent next year.

- Next year 21-year-olds and 22 year olds are due to become eligible for the NLW. This will reduce median hourly pay for the NLW-eligible population, lowering the increase required to hit the target.

The LPC’s forecasts rely on wage projections which are currently more uncertain than usual. Therefore the next increase designed to hit the target rate in 2024 is calculated as a range which spans from £10.82 to £11.35.

PENALTIES FOR NOT PAYING THE NATIONAL LIVING WAGE

September 2015 saw new fines declared for businesses found not to be paying the National Living Wage. They became double the penalties levied for non-compliance, increasing from 100% of arrears owed to 200% (this is reduced to half if paid within 14 days). The maximum fine remains at £20,000 per worker but an extra penalty – of being disqualified as a company director for up to 15 years – is also available to judges in NLW court cases.

If you’re looking for advice on what to pay your staff or how to structure pay packages for new employees, call our business development team for some free, impartial advice.

- Megan Allmark, Business Development Manager 07874 867456, MeganA@kpir.co.uk

- Joe Jardine, Business Development Manager, 07874 867453, JoeJ@kpir.co.uk

- Kirsty Walley, Business Development Manager, 07541 645045 KirstyW@kpir.co.uk

- Will Stanley, Head of Driving, 07513 727636 WillS@kpir.co.uk

The graph below shows the forecasted path for the National Living Wage to reach two-thirds of median earnings in 2024.