Do I need a National Insurance number to work in the UK?

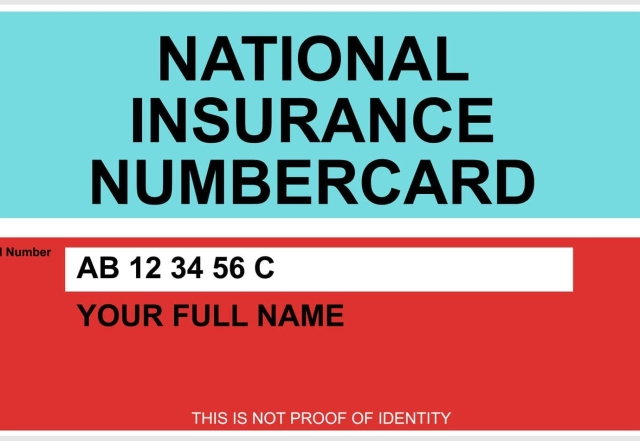

Everyone who works in the UK who earns over £242 each week must contribute towards National Insurance (NI) which pays for things like hospitals and state pension. To pay National Insurance, you must have an NI number. If you have recently arrived in the UK, you may not have a National Insurance number. You can start work without a National Insurance number. Any individual without an NI number is allocated a temporary number by HM’s Dept for Revenue and Customs (HMRC).

You will then be allocated your personal NI number by the HMRC after a few weeks. The HMRC then match up your temporary NI number with your new permanent NI number. Matching up these two NI numbers can take the HMRC up to 9 months to complete, but in the meantime your National Insurance payments are still being paid by both you and your employer (KPI Recruiting). Once your two NI numbers have been matched, funds will then show up against your new, permanent NI number.

How to speed up the process of matching your temporary National Insurance number with your new personal national insurance number:

It is possible to try to speed up this process by contacting the HMRC. This is what to do:

- Call the HMRC helpline on 0300 200 3300

- Listen to the recorded messages and answer any questions when prompted,

- When asked

“To direct your call to the right place I would like to know why you are calling today so tell me in a few words what’s reason for your call?”

Answer: Personal Tax Account

“it’s about your online personal tax account, is that right?”

Answer: Yes

“So go ahead in few words what’s the reason for your call?”

Answer: Please can I speak to an advisor?

“Please say one of the following, Pensioners, Tax Codes, Refunds, Tax Calculations, Self-Assessment, deceased or something else”

Answer: Something Else

“And are you calling about your own tax?”

Answer: Yes - A further recorded message is played advising you’re about to enter a queue for an advisor, the message will ask if you would like to take part in a survey after your call, press 1 to take part or 2 to opt-out.

- You will then wait in the queue for an advisor, be prepared to wait on hold for considerable length of time during busy periods.

- Once you have reached an advisor explain to them you began employment with KPI Recruiting Ltd whilst waiting for a NI insurance number and the earnings from this employment are missing from your online tax account, now you have your number you would like your account to be matched up to your temporary one.

- The advisor will ask for some information, this can include, Full Name, Address, NI Number, DOB, they will also ask for KPI Recruiting Ltd PAYE reference number, which is 709/GA18871.

- The advisor will confirm that the HMRC hold two accounts with your details and that they will now merge them both which could take up to a few months to complete. They will ask you to provide a contact number and create a one-word password for any future contact.

Since 2008 KPI has paid millions of pounds worth of National Insurance payments on behalf of thousands of temporary and permanent employees. If you’re looking for work in the Industrial, Driving, Commercial, hospitality, Care, IT or Rail sectors, we here to help. You can find our jobs here.